OSC Issues Report on New York Nonprofits

Per the notice below, the Office of the New York State Comptroller (OSC) has issued a report on nonprofit entities in New York State.

DiNapoli Releases Report on Nonprofit Industry

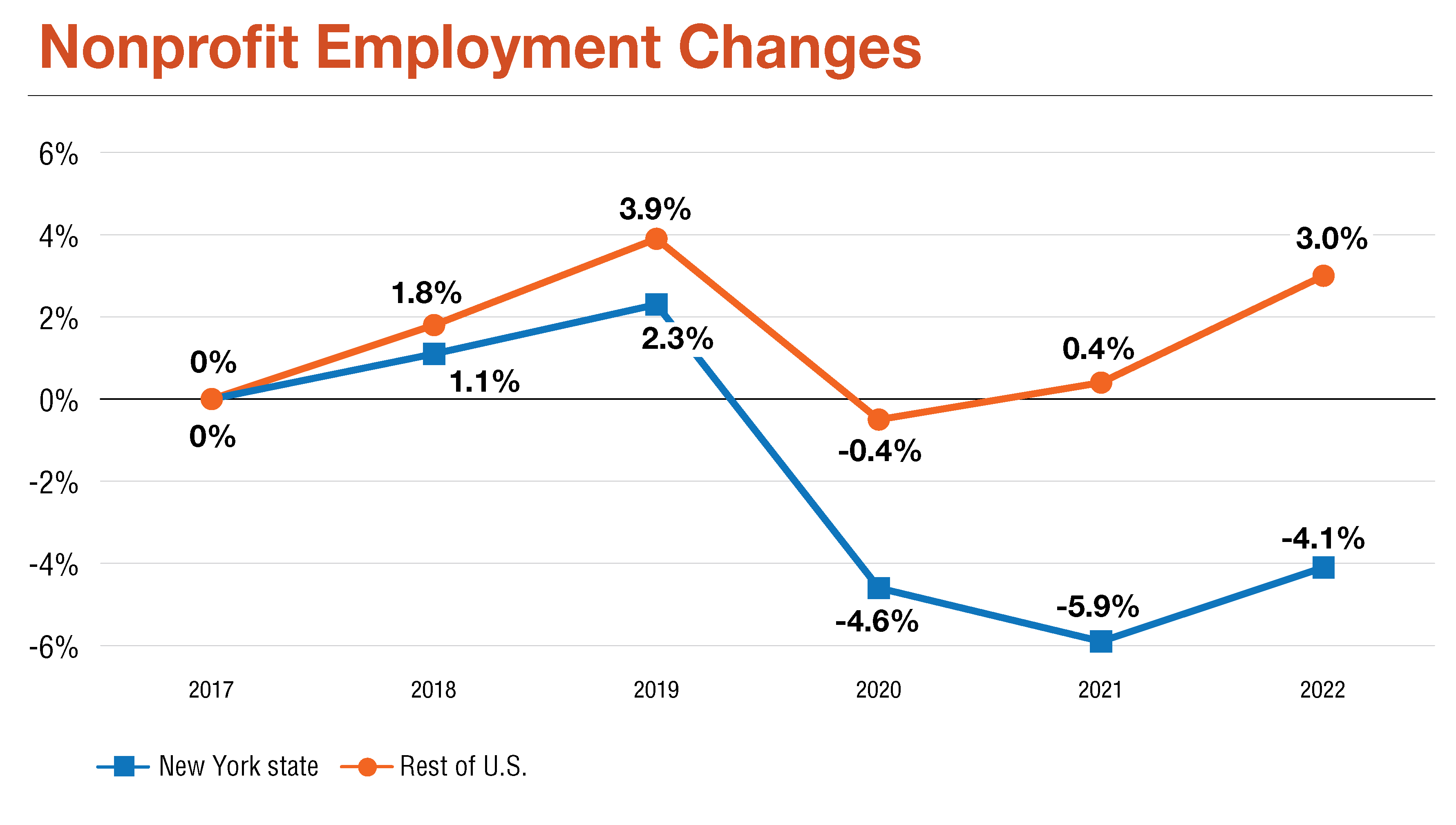

State Comptroller Thomas P. DiNapoli released a report that showed nonprofit organizations in 2022 provided 1.3 million jobs to New Yorkers, just over 1 in 6 private sector jobs in the state. While the number of nonprofits increased nationally between 2017-2022, they declined in New York and the number of jobs also fell by 4.1%.

“Nonprofits play an important role in our state and local economies and are an essential part of the fabric of the communities they serve, but their numbers are shrinking,” DiNapoli said. “Many nonprofits rely on government funding to support their services, and contract delays and slow payments have contributed to some of the challenges they face. Policymakers need to ensure state agencies process contracts and payments for nonprofits on time, so they can carry out the work on which so many New Yorkers rely.”

Nonprofits Role in State Economy

In 2022, there were over 344,000 nonprofit organizations in the U.S., 3.1% of all private sector establishments. With 33,536, nearly 1 in 10 of these nonprofits were located in New York, comprising 5% of the private sector statewide. Nonprofits provided 12.8 million jobs nationwide in 2022, with the greatest number (10.6%) in New York. In some regions of the state, they supported more than 1 in 5 private sector jobs. Nonprofits in New York paid $96.8 billion in wages in 2022 (11.1% of the nationwide total). Average annual wages paid by nonprofits in the state were lower than in the public and private sectors, in contrast to nonprofits in the rest of the country, where average wages were more in line with public and private sectors. Statewide, three industry sectors accounted for 78.9% of nonprofits and 89.3% of nonprofit jobs in 2022. The health care and social assistance sector had the largest share of nonprofit establishments (41.3%) and jobs (61.4%). Other sectors with significant employment in New York include educational services, other services, professional and business services, and leisure and hospitality.

Decline in Nonprofits Since 2017

Although New York ranks among the highest for nonprofit establishments and employment, both numbers declined between 2017 and 2022. The state experienced a loss of 626 nonprofits between 2017-2019, and recovered 453 over the following three years, a net loss of 173 establishments through 2022. Prior to 2020, employment in nonprofits was growing in nearly every state and New York had the fourth highest increase with 32,348 additional jobs. During the pandemic, the number of jobs at nonprofits plummeted nationwide, with a loss of 580,426. Approximately 1 in every 5 nonprofit jobs lost was in New York. By 2022, employment at other private sector establishments nationally had fully recovered, but nonprofits were still struggling. New York had the lowest nonprofit job recovery, regaining just 7.4% of the jobs lost and fewer jobs than in 2017. In addition to lagging other states, job growth for nonprofits in New York was also lower than that for other private sector establishments and the public sector from 2017 to 2022. During the five-year period, nonprofit employment declined by 4.1% in comparison to a 1.5% decrease for the public sector and a 1% increase all other private sector establishments.

Regional Impact

DiNapoli’s report found that in 2022, almost 60% of the state’s nonprofits and two-thirds of their employment were in the downstate regions, with nearly half of all nonprofit jobs located in New York City. However, nonprofits jobs are a higher share of private sector employment in upstate regions. For example, in the Southern Tier, 1 in 4 private sector jobs are at a nonprofit. In 2022, nonprofit employment in all regions remained below 2017 levels, with the largest declines in the Mohawk Valley (-12.3%), Western New York (-10.3%), and the Capital Region (-9.5%).

State Contract and Payment Delays

Nonprofits provide a number of services on behalf of the state, including mental health and public assistance, recovery aid from storms and other weather events, public safety, food, and arts and cultural programs. Under state law, contracts are to be executed within 150 to 180 days after the funding for the program became law. As noted in DiNapoli’s 2023 annual report on the implementation of the prompt contracting requirements, over 5,000 contracts, or 56%, with state agencies in 2023 were processed late. A high share of late contracts is not a recent phenomenon; late contracts have been a persistent problem faced by nonprofits. When contracts or payments are late, nonprofits may decrease the services provided, defer hiring or lay off workers, or rely on loans or lines of credit to get by. State Comptroller DiNapoli reiterated his call for nonprofits’ contracts and payments to be processed by state agencies in a timely manner to ensure steady funding and avoid any disruption of services.